21+ new mexico salary calculator

The maximum could be as high as 43 to bring the lowest-paid employees up to a minimum of 15hour. No state-level payroll tax.

Opening College Football Week 0 Odds Spreads And Early Predictions

Updated for April 2022.

. People in the Specialized pay bands Information Technology Architect. The income tax rate ranges from 17 to 59. The median household income is 46744 2017.

The New Mexico Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New. New Mexico has a progressive income tax system with four brackets that are each dependent on income level and filing status. In addition to pay raises for eligible employees all State of New Mexico employees shall be paid a minimum of 15 per hour.

This is the amount of salary you are paid. The personal income tax rate in Mexico is progressive and ranges from 192 to 35 depending on your income for residents while non-residents see tax rates that range from 0 to 30. Overview of New Mexico Taxes.

Well do the math for youall you need to do is. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in New Mexico. Salary Paycheck Calculator New Mexico Paycheck Calculator Use ADPs New Mexico Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

To use our New Mexico Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. After a few seconds you will be provided with a full. Try out the take-home calculator choose the 202223 tax.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Mexico. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of. Calculate your New Mexico net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Mexico.

The Mexico tax calculator assumes this is your annual salary before tax. The adjusted annual salary can be calculated as. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Simply enter their federal and state W-4 information. These assume a 40-hour working week. The minimum wage in New Mexico means that a full-time worker can expect to earn the following sums as a minimum before tax.

Has standard deductions and. The tax rates which vary. At a minimum eligible employees will receive a raise of 4.

If you wish to enter you monthly salary weekly or hourly wage then select. New Mexico Salary Paycheck Calculator Results.

Teaser Calculator Tool For Teaser Betting

Nms July 2020 By Livestock Publishers Issuu

Free Parlay Calculator And Parlay Odds At

New Mexico General Schedule Pay Tables

Cage Cashier Resume Samples Velvet Jobs

New Mexico Paycheck Calculator Smartasset

Customized 1 2 Inches Round Stickers Sheets Labels Order 0 5 Personalized Circular Labels At Customizedstickers Com

New Mexico Sports Betting Is It Legal Claim 5 000 At Nm Sportsbooks

New York Gambling Winnings Tax Calculator For October 2022

Colorado Gaming Commission Fines Worldpay 130k

Arizona Gambling Winnings Tax Calculator 2022 Betarizona Com

How To Update Your License And Registration When You Move Mymove

New Mexico Salary Paycheck Calculator Gusto

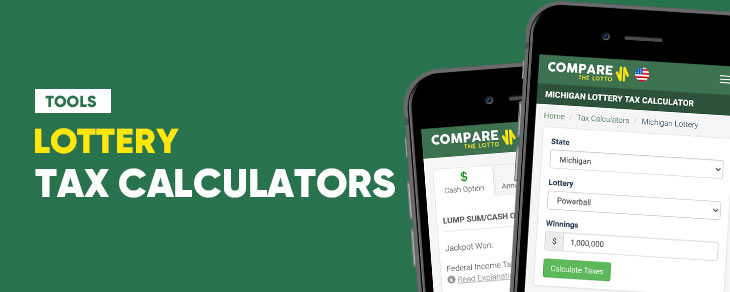

Comparethelotto Usa Lottery Odds Calculators Results And More

Free New Mexico Payroll Calculator 2022 Nm Tax Rates Onpay

Usa Lottery Tax Calculators Comparethelotto Com

User Experience Salaries Calculator 2022 Measuringu